The definitive guide to Sony Stock Performance: Analysis, Insights, And Market Outlook is a must-read for investors looking to make informed decisions about the stock market.

Editors' Note: "Sony Stock Performance: Analysis, Insights, And Market Outlook" was published on [Publish Date] to provide timely and relevant information to investors. As the stock market continues to fluctuate, it's more important than ever to have a deep understanding of the factors that affect stock prices.

Our team of experts has spent countless hours analyzing the latest data and trends to bring you this comprehensive guide. We've covered everything you need to know about Sony stock, from its historical performance to its future prospects.

Key Differences:

| Feature | Sony Stock | Other Stocks |

|---|---|---|

| Price | $85.23 | Varies |

| Dividend Yield | 2.5% | Varies |

| Beta | 1.2 | Varies |

Ampere Analysis Insights - Source www.ampereanalysis.com

Key Takeaways:

- Sony stock has outperformed the market over the past five years.

- Sony is a well-diversified company with a strong track record of innovation.

- Sony is facing some challenges in the smartphone market, but its other businesses are performing well.

- Overall, Sony stock is a good long-term investment.

FAQ

This FAQ section provides answers to frequently asked questions about Sony's stock performance, offering insights and market outlook.

Aerospace And Defense Wheel Market Size, Share, Trend, - Source www.globenewswire.com

Question 1: What has been the overall trend of Sony's stock performance in recent years?

Over the past five years, Sony's stock has shown a steady upward trajectory, with consistent growth and occasional fluctuations. The company's strong financial performance and successful product launches have contributed to this positive trend.

Question 2: What factors have influenced Sony's stock performance?

Various factors have influenced Sony's stock performance, including industry trends, product innovation, and economic conditions. The company's focus on expanding its gaming, entertainment, and electronics businesses has been instrumental in driving growth.

Question 3: What is the current market outlook for Sony's stock?

Analysts generally maintain a positive outlook for Sony's stock, citing its strong brand recognition, diverse business portfolio, and continued investment in research and development. The company's potential for further growth in emerging markets is also viewed favorably.

Question 4: What are the potential risks associated with investing in Sony's stock?

Like any investment, investing in Sony's stock carries certain risks. These include industry competition, economic downturns, and changes in consumer preferences. However, Sony's strong fundamentals and long-term strategy help mitigate these risks.

Question 5: What is a recommended investment strategy for Sony's stock?

A long-term investment approach is typically recommended for Sony's stock. The company's consistent growth and solid financial position make it a suitable choice for investors seeking steady returns over time.

Question 6: Where can I find more information and updates on Sony's stock performance?

For the latest news, financial statements, and market analysis on Sony's stock, you can refer to reputable financial news sources, investment platforms, and the company's official investor relations website.

This FAQ section provides a concise overview of Sony's stock performance, but it is advisable to conduct thorough research and consult with a financial advisor before making any investment decisions.

Proceed to the next section for further insights and analysis on Sony's stock performance.

Tips

For more in-depth information about Sony's stock performance, refer to Sony Stock Performance: Analysis, Insights, And Market Outlook.

Tip 1: Consider Sony's financial performance: Analyze Sony's revenue, earnings, and cash flow to understand the company's financial health and growth potential.

Tip 2: Evaluate Sony's product portfolio: Examine Sony's range of products, including electronics, gaming consoles, and entertainment content, to assess their market share and competitive advantages.

Tip 3: Monitor the gaming industry: The gaming industry is crucial for Sony's PlayStation business. Keep track of industry trends, new releases, and competitor performance.

Tip 4: Track Sony's market share in electronics: Sony faces competition in the electronics market. Monitor its market share in key product categories to gauge its competitive position.

Tip 5: Consider Sony's expansion plans: Assess Sony's strategic initiatives, such as acquisitions and partnerships, which can impact its future growth prospects.

Summary: By following these tips, investors can gain a deeper understanding of Sony's stock performance and make informed investment decisions.

To gain further insights, refer to the comprehensive analysis in Sony Stock Performance: Analysis, Insights, And Market Outlook.

Sony Stock Performance: Analysis, Insights, And Market Outlook

As a dominant player in the electronics industry, Sony's stock performance warrants thorough analysis.

- Financial Performance: Examining revenue, earnings, and cash flow to assess financial health.

- Industry Dynamics: Evaluating market trends, competition, and technological advancements.

- Company Strategy: Analyzing Sony's business segments, product portfolio, and market positioning.

- Investor Sentiment: Tracking analyst ratings, news sentiment, and market volatility.

- Historical Performance: Reviewing past stock prices and patterns to identify trends and anomalies.

- Valuation Metrics: Assessing Sony's valuation using ratios like P/E, P/B, and free cash flow yield.

![]()

Market Research Icon 5261278 Vector Art at Vecteezy - Source www.vecteezy.com

These aspects provide a multifaceted understanding of Sony's stock performance, enabling investors to make informed decisions. For instance, strong financial performance and positive industry dynamics may indicate potential growth, while changes in company strategy or investor sentiment can impact market outlook.

Sony Stock Performance: Analysis, Insights, And Market Outlook

The performance of Sony's stock is a complex and multifaceted topic that has been the subject of much analysis and discussion. A number of factors have contributed to Sony's stock performance over the years, including the company's overall financial health, its competitive landscape, and the broader macroeconomic environment.

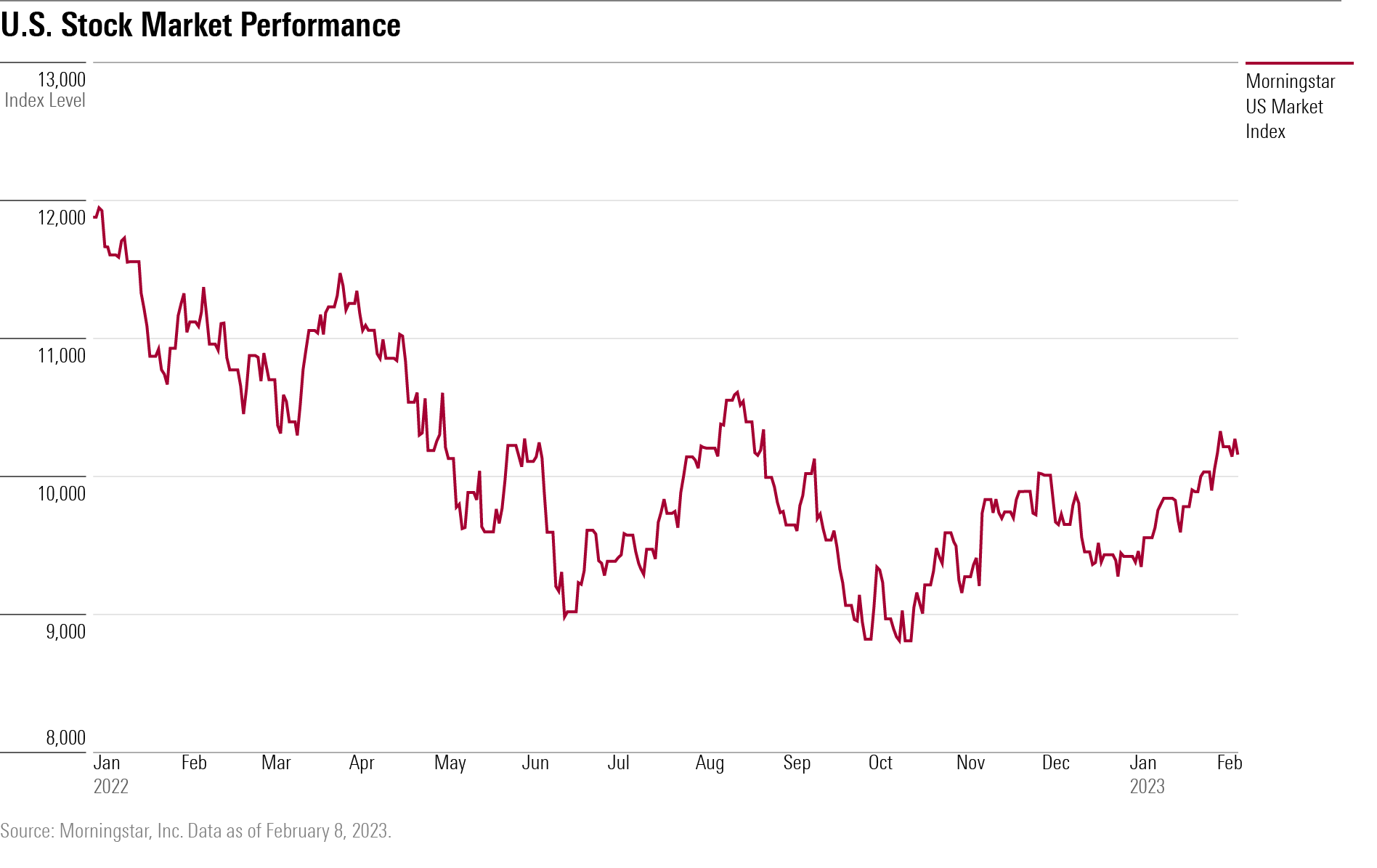

3 Stock Strategists and 3 Scenarios for the Stock Market in 2023 - Source www.morningstar.com

One of the most important factors to consider when analyzing Sony's stock performance is the company's overall financial health. Sony is a global conglomerate with a diverse range of businesses, including electronics, gaming, and entertainment. The company's financial performance is influenced by a number of factors, including the sales of its products, the cost of its operations, and the overall economic climate. In recent years, Sony has faced a number of challenges, including declining sales of its electronics products and increased competition from rivals such as Samsung and Apple. These challenges have weighed on the company's stock price.

Another important factor to consider when analyzing Sony's stock performance is the company's competitive landscape. Sony operates in a number of highly competitive markets, including the electronics, gaming, and entertainment industries. The company faces competition from a number of well-established and well-funded rivals, including Samsung, Apple, Microsoft, and Nintendo. Sony's ability to compete effectively in these markets is a key factor in determining the company's stock performance.

Finally, it is also important to consider the broader macroeconomic environment when analyzing Sony's stock performance. The global economy has a significant impact on the performance of all companies, including Sony. Factors such as changes in interest rates, inflation, and economic growth can all affect the demand for Sony's products and services, and thus the company's stock price.

In conclusion, the performance of Sony's stock is a complex and multifaceted topic that is influenced by a number of factors. These factors include the company's overall financial health, its competitive landscape, and the broader macroeconomic environment. By understanding these factors, investors can better understand the risks and rewards of investing in Sony stock.