The End of Provisional Gasoline Tax: Impact on Consumers and Economy

Editor's Note: The End of Provisional Gasoline Tax: Impact on Consumers and Economy has been published today. This is an important topic to understand because it will have a direct impact on your finances and the economy as a whole.

We've done the analysis, dug into the information, and put together this End of Provisional Gasoline Tax: Impact on Consumers and Economy guide to help you make the right decision for your situation.

Key Differences:

| Characteristic | Provisional Gasoline Tax | End of Provisional Gasoline Tax |

|---|---|---|

| Tax Rate | 18.4 cents per gallon | 0 cents per gallon |

| Impact on Consumers | Increased gasoline prices | Decreased gasoline prices |

| Impact on Economy | Reduced economic activity | Increased economic activity |

Transition to main article topics:

FAQ

The provisional gasoline tax was implemented as a measure to alleviate the rising costs of fuel and its impact on consumers and the economy. The tax was expected to have several significant impacts, both positive and negative. The following are some of the most commonly asked questions regarding the provisional gasoline tax:

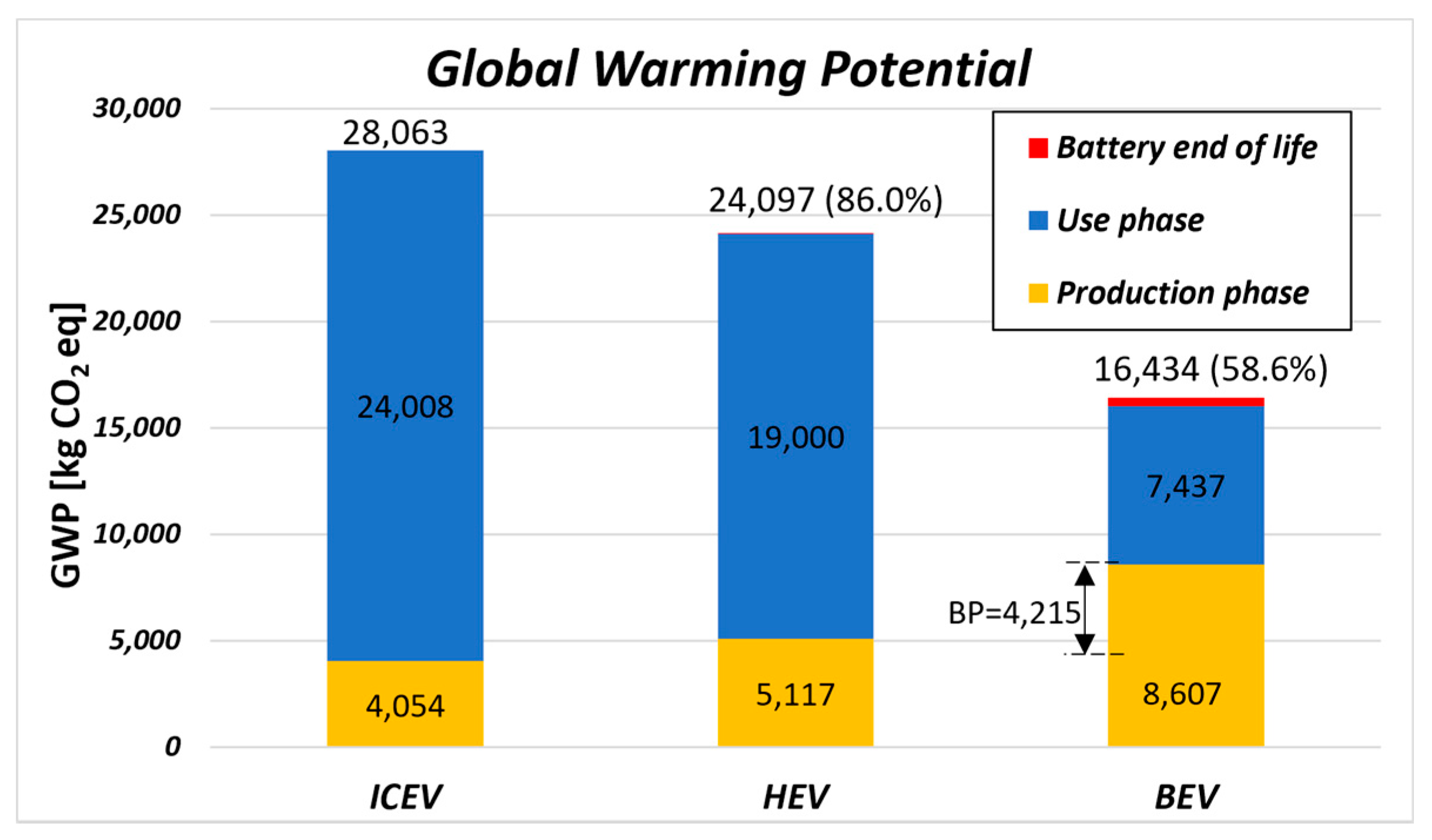

Sustainability | Free Full-Text | A Life Cycle Environmental Impact - Source www.mdpi.com

Question 1: What was the purpose of the provisional gasoline tax?

Answer: The provisional gasoline tax was implemented as a means to reduce the financial burden of rising fuel prices on consumers and the economy. By imposing a tax on gasoline, the government aimed to generate revenue that could be used to offset the increased costs faced by individuals and businesses.

Question 2: How did the provisional gasoline tax impact consumers?

Answer: The provisional gasoline tax had a direct impact on consumers, as it resulted in increased fuel prices. This led to higher transportation costs, which in turn affected the prices of goods and services. As a result, consumers faced an overall increase in their living expenses.

Question 3: What were the economic effects of the provisional gasoline tax?

Answer: The provisional gasoline tax had both positive and negative economic effects. On the one hand, it provided the government with additional revenue that could be used to support various public programs. On the other hand, it contributed to inflationary pressures, as businesses passed on the increased fuel costs to consumers in the form of higher prices for goods and services.

Question 4: What was the impact of the provisional gasoline tax on the environment?

Answer: The provisional gasoline tax had an indirect impact on the environment. By increasing fuel prices, the tax encouraged consumers to reduce their fuel consumption. This led to a decrease in greenhouse gas emissions, as vehicles consume less fuel when driven less.

Question 5: How did the provisional gasoline tax affect specific industries?

Answer: The provisional gasoline tax had a significant impact on industries that rely heavily on transportation, such as the transportation and logistics sectors. These industries faced increased costs due to higher fuel prices, which they passed on to their customers in the form of higher prices for goods and services.

Question 6: What are the long-term implications of the provisional gasoline tax?

Answer: The long-term implications of the provisional gasoline tax are still being debated. Some analysts believe that the tax will encourage consumers to shift to more fuel-efficient vehicles or alternative modes of transportation, such as public transit or cycling. Others argue that the tax will simply lead to higher inflation and an overall increase in the cost of living.

Summary: The provisional gasoline tax had a significant impact on both consumers and the economy, both positive and negative. It is important to consider all of these factors when assessing the overall impact of the tax.

Transition: The provisional gasoline tax is a complex issue with far-reaching implications. By understanding the answers to these commonly asked questions, you can gain a better understanding of its impact on consumers, the economy, and the environment.

Tips

The provisional petrol tax is about to end, and this will have a significant impact on consumers and the economy. Here are some tips to help you prepare for the change:

Tip 1: Calculate how much you will save on gas each month. This will help you budget for the future and make informed decisions about your spending.

Tip 2: Consider using the money you save on gas to pay down debt, boost savings, or invest in other areas. This can help you improve your financial well-being in the long run.

Tip 3: Be prepared for increased traffic congestion. As gas prices decrease, more people may start driving, leading to increased traffic congestion. Plan ahead and allow for extra travel time.

Tip 4: Explore alternative transportation options. End Of Provisional Gasoline Tax: Impact On Consumers And Economy With gas prices falling, this may be a good time to consider using public transportation, walking, or biking instead of driving.

Tip 5: Monitor gas prices in your area. Gas prices can fluctuate significantly, so it's important to stay informed about the latest trends.

Summary: The end of the provisional petrol tax will have a significant impact on consumers and the economy. By following these tips, you can prepare for the change and make the most of the savings.

Transition: For more information on the end of the provisional petrol tax, visit the

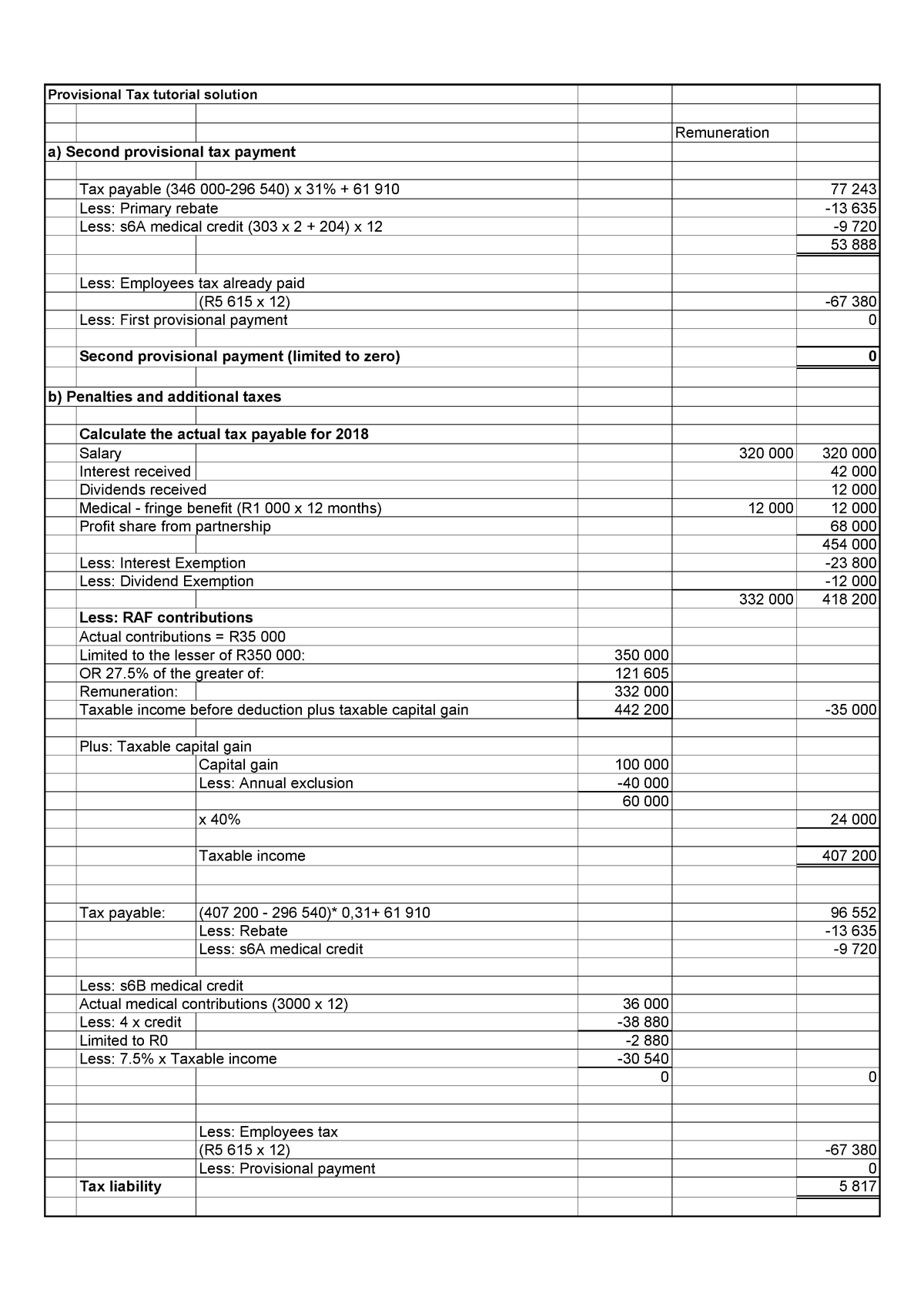

Provisional Tax Solutions - Provisional Tax tutorial solution - Source www.studocu.com

website.

End Of Provisional Gasoline Tax: Impact On Consumers And Economy

The expiration of the provisional gasoline tax would affect various aspects, including consumer spending, inflation, and economic growth.

- Consumer Relief: Lower gas prices would provide immediate financial relief to consumers.

- Inflation Mitigation: Reduced transportation costs could ease inflationary pressures.

- Increased Spending: Savings from lower gas prices may boost consumer spending in other areas.

- Economic Stimulus: Increased consumer spending can stimulate economic growth.

- Government Revenue Loss: The government would lose tax revenue, impacting its fiscal balance.

- Transportation Infrastructure Funding: The tax was earmarked for transportation projects, which may now see reduced funding.

The interplay between these aspects is complex. While consumers may benefit from lower prices, the government faces revenue challenges. The overall impact on the economy depends on how the tax savings are spent, whether they stimulate growth or lead to inflation. Additionally, the allocation of transportation funds needs to be addressed to maintain infrastructure.

Provisional attachment of cash-credit facility - Section 83 of the CGST - Source www.taxmanagementindia.com

End Of Provisional Gasoline Tax: Impact On Consumers And Economy

The end of the provisional gasoline tax will have a significant impact on consumers and the economy. The tax, which was imposed in 2011, has been a significant source of revenue for the government, but it has also been a burden for consumers. The tax has added an average of 18.4 cents per gallon to the cost of gasoline, which has made it more expensive for people to drive. This has had a ripple effect on the economy, as businesses have passed on the cost of the tax to consumers in the form of higher prices for goods and services.

/GettyImages-636251470-5909210f5f9b586470dff929.jpg)

Как по-високите данъци за богатите в крайна сметка нараняват бедните? - Source www.greelane.com

The end of the tax will provide some relief to consumers and businesses. The average household will save about $100 per year on gasoline costs, and businesses will be able to lower their prices for goods and services. This will help to boost the economy and create jobs. In addition, the end of the tax will help to reduce pollution, as people will drive less due to the lower cost of gasoline.

Overall, the end of the provisional gasoline tax is a positive development that will benefit consumers, businesses, and the economy.

Table: Impact of the End of the Provisional Gasoline Tax

| Group | Impact |

|---|---|

| Consumers | Lower gasoline costs |

| Businesses | Lower transportation costs |

| Economy | Increased economic activity |

| Environment | Reduced pollution |

Conclusion

The end of the provisional gasoline tax is a significant event that will have a positive impact on consumers, businesses, and the economy. The tax has been a burden for consumers and businesses, and its end will provide some much-needed relief. The end of the tax will also help to boost the economy and create jobs, and it will reduce pollution.

The end of the provisional gasoline tax is a step in the right direction, and it is a sign that the government is committed to helping consumers and businesses. The tax was a burden that was holding back the economy, and its end will help to unleash the economy's full potential.