Our team of experts has done extensive research and analysis to put together this Calculate Imu 2024: Easy Steps For Accurate Property Tax Assessment guide. We have compiled the most up-to-date information on property tax assessment laws and procedures, and we have presented it in a clear and concise manner.

| Key Differences | Key Takeaways |

|---|---|

| Thorough understanding of property tax assessment process | Ensures fair and accurate property tax assessments |

| Provides clear and easy-to-follow steps | Empowers property owners to calculate their own assessments |

| Includes up-to-date information on property tax assessment laws and procedures | Ensures compliance with the latest regulations |

This guide will help you to:

- Understand the different factors that are used to calculate your property tax assessment

- Calculate your property tax assessment using the official formula

- Identify and correct errors in your property tax assessment

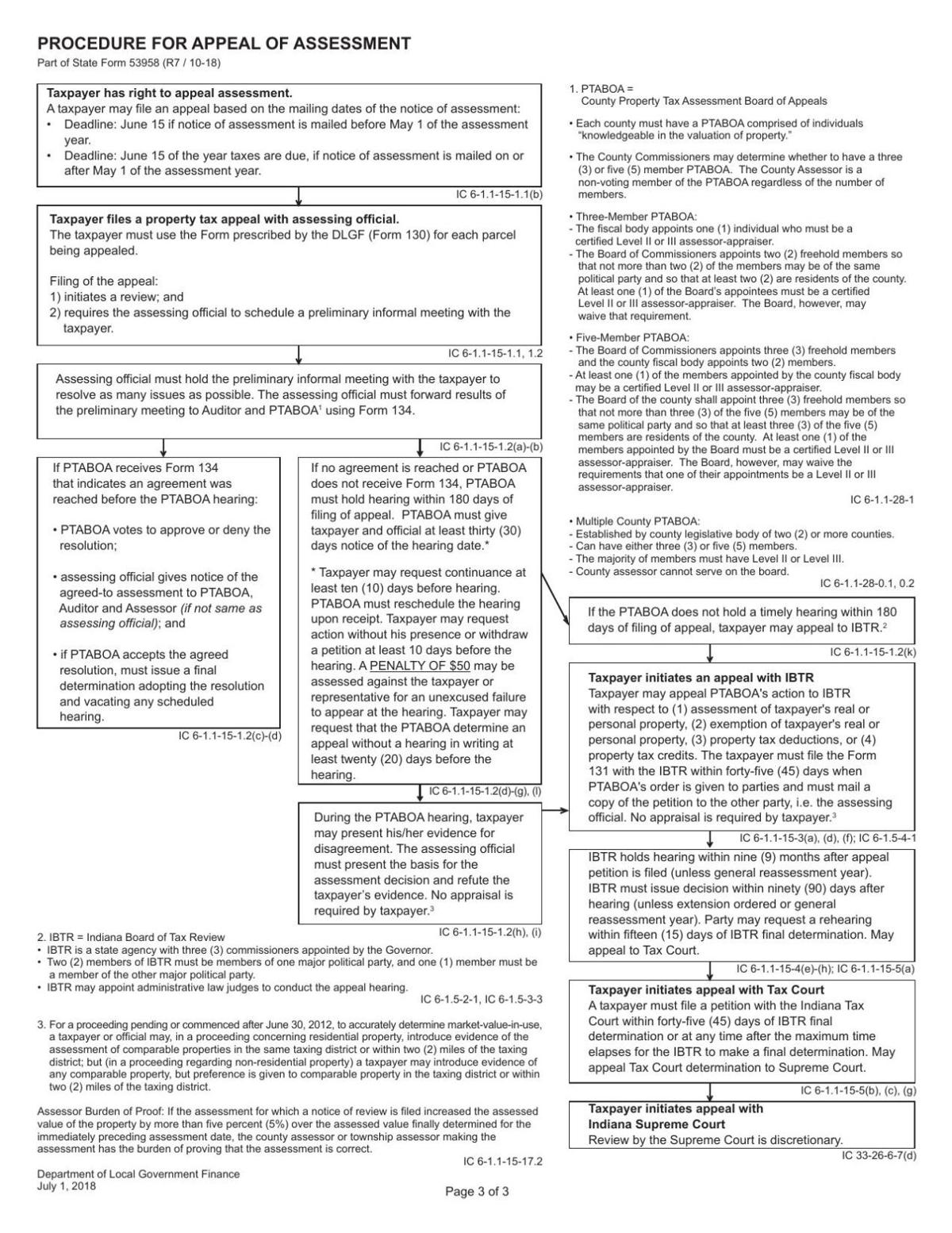

- File a property tax appeal if you believe your assessment is inaccurate

Lake assessor expecting numerous property assessment appeals - Source www.nwitimes.com

By following the steps outlined in this guide, you can ensure that your property tax assessment is accurate and that you are paying your fair share of taxes.

FAQ

This comprehensive FAQ section provides answers to frequently asked questions regarding calculating IMU 2024, aiming to enhance understanding and facilitate accurate property tax assessments.

Property tax relief bill for seniors passes the Kentucky Senate | WEKU - Source www.weku.org

Question 1: What exactly is IMU?

IMU stands for Imposta Municipale Unica, which translates to Single Municipal Tax. It is an annual property tax levied by Italian municipalities on the possession of real estate properties, including residential homes, commercial buildings, and land.

Question 2: How is IMU calculated?

IMU is calculated based on the taxable value of the property, known as rendita catastale, which is determined by the Italian Revenue Agency. The taxable value is adjusted by various coefficients, including the cadastral category, location, and presence of specific amenities. The resulting amount is then multiplied by the applicable IMU tax rate set by the municipality.

Question 3: Who is responsible for paying IMU?

The owner of the property as of January 1st of the tax year is generally liable for paying IMU. However, there are certain exceptions, such as in cases of usufruct or property rental.

Question 4: Are there any exemptions or reductions to IMU?

Yes, certain properties are exempt from IMU, such as the primary residence of Italian citizens living abroad and properties owned by non-profit organizations. Additionally, municipalities may offer reductions for specific categories of properties, such as historical buildings or properties in rural areas.

Question 5: When is IMU due?

IMU is typically paid in two installments: the first installment is due by June 16th, and the second installment is due by December 16th. Municipalities may have different deadlines, so it is advisable to check with the local authorities.

Question 6: What happens if I fail to pay IMU?

Late or unpaid IMU payments may result in penalties and interest charges. Municipalities can also initiate legal proceedings to recover the outstanding amount, which may lead to additional costs and potential seizure of the property.

Understanding the intricacies of IMU calculations and payment requirements is crucial for accurate property tax assessments and avoiding any potential penalties. Seeking professional advice from tax experts or real estate professionals can further ensure compliance and optimize tax liabilities.

Proceed to the next section to delve deeper into the process of calculating IMU in 2024.

Tips for Accurate Property Tax Assessment

Property tax assessment is a crucial step in determining the amount of taxes owed on a property. To ensure an accurate assessment, Calculate Imu 2024: Easy Steps For Accurate Property Tax Assessment consider the following tips:

Tip 1: Gather Necessary Documents

Collect property deeds, tax bills, and recent appraisals to provide a comprehensive view of the property's history and current value.

Tip 2: Research Comparable Properties

Compare your property to similar properties in the area to determine a fair market value. Use online databases or consult with a real estate agent to gather data.

Tip 3: Consider Property Features

Take into account factors that affect property value, such as square footage, number of rooms, amenities, and location. These features contribute to the overall assessment.

Tip 4: Inspect the Property

Conduct a thorough inspection of the property to identify any potential issues or improvements that may affect its value. This includes checking for repairs, renovations, and any structural damage.

Tip 5: Appeal the Assessment

If you believe the assessment is inaccurate, you have the right to file an appeal. Provide evidence to support your claim, such as updated appraisals or comparable sales data.

By following these tips, you can increase the accuracy of your property tax assessment, potentially reducing your tax burden and ensuring a fair valuation.

Calculate Imu 2024: Easy Steps For Accurate Property Tax Assessment

- Determine Taxable Base: Calculate the value of the property based on its current market value, building characteristics, and location.

![Home [gregfreemanforarizona.com] Home [gregfreemanforarizona.com]](https://gregfreemanforarizona.com/wp-content/uploads/2024/01/greg-freeman-2.png)

Home [gregfreemanforarizona.com] - Source gregfreemanforarizona.com - Apply Tax Rates: Multiply the taxable base by the applicable tax rate set by the local authority.

Director of Equalization - Source hamlinco.us - Consider Exemptions: Explore potential exemptions or reductions based on property usage, ownership status, or specific circumstances.

- Factor In Deductions: Subtract any eligible deductions, such as maintenance expenses or renovations that enhance the property's value.

- Calculate Installment Payments: Divide the total tax liability by the number of installments and determine the payment schedule.

- Review and Verify: Carefully check all calculations, including any supporting documentation, to ensure accuracy and avoid potential errors or overpayments.

Understanding these key aspects is crucial for accurate property tax assessment. For instance, determining the taxable base correctly ensures a fair valuation of the property, while applying the correct tax rates prevents overpayment or underpayment. Additionally, considering exemptions and deductions can significantly reduce the tax liability, leading to potential savings.

Calculate Imu 2024: Easy Steps For Accurate Property Tax Assessment

Calculating IMU (Imposta Municipale Unica, or Single Municipal Tax) for 2024 is crucial for accurate property tax assessment. This tax is based on the cadastral value of properties and is used to fund local services. To ensure a fair and accurate assessment, it's essential to understand the calculation process, which involves several key steps.

Free Tax Assessment Appeal Letter Template - Edit Online & Download - Source www.template.net

The first step is to determine the cadastral value of the property, which is set by the Revenue Agency based on various factors such as location, type of property, and size. The next step is to apply the relevant tax rate, which varies depending on the municipality where the property is located. The resulting amount is then multiplied by any applicable deductions or exemptions.

Understanding the connection between the different steps in the IMU calculation process is essential for property owners who want to ensure an accurate assessment. By following these steps carefully and considering the factors that influence the cadastral value and tax rate, property owners can verify the accuracy of their IMU bills and make informed decisions regarding any potential disputes or adjustments.

Conclusion

Calculating IMU for 2024 plays a significant role in ensuring that property taxes are assessed fairly and accurately. By understanding the connection between the cadastral value, tax rate, and applicable deductions or exemptions, property owners can effectively review and verify their IMU bills.

Furthermore, staying informed about any changes in tax rates or regulations related to IMU can help property owners proactively manage their tax obligations and avoid any potential financial surprises. It is also essential for local municipalities to provide clear and accessible guidance on IMU calculations to promote transparency and ensure that property owners have the necessary information to make informed decisions.