Editor's Notes: 厚生年金: 老後の安定した生活のために知っておきたい基礎知識 have published today date". This is an important topic to read because it can affect your financial security in retirement.

遺族厚生年金とは?受給資格や金額・手続き方法や必要書類について - Source green-osaka.com

Key differences or Key takeways:

Main article topics:

What is 厚生年金?

厚生年金 is a Japanese public pension program that provides retirement, disability, and survivor benefits to employees and their families.

Who is eligible for 厚生年金?

All employees who are covered by the Japanese social insurance system are eligible for 厚生年金.

How much does 厚生年金 cost?

The amount of 厚生年金 contributions is based on the employee's salary and is split between the employee and the employer.

How much will I receive from 厚生年金?

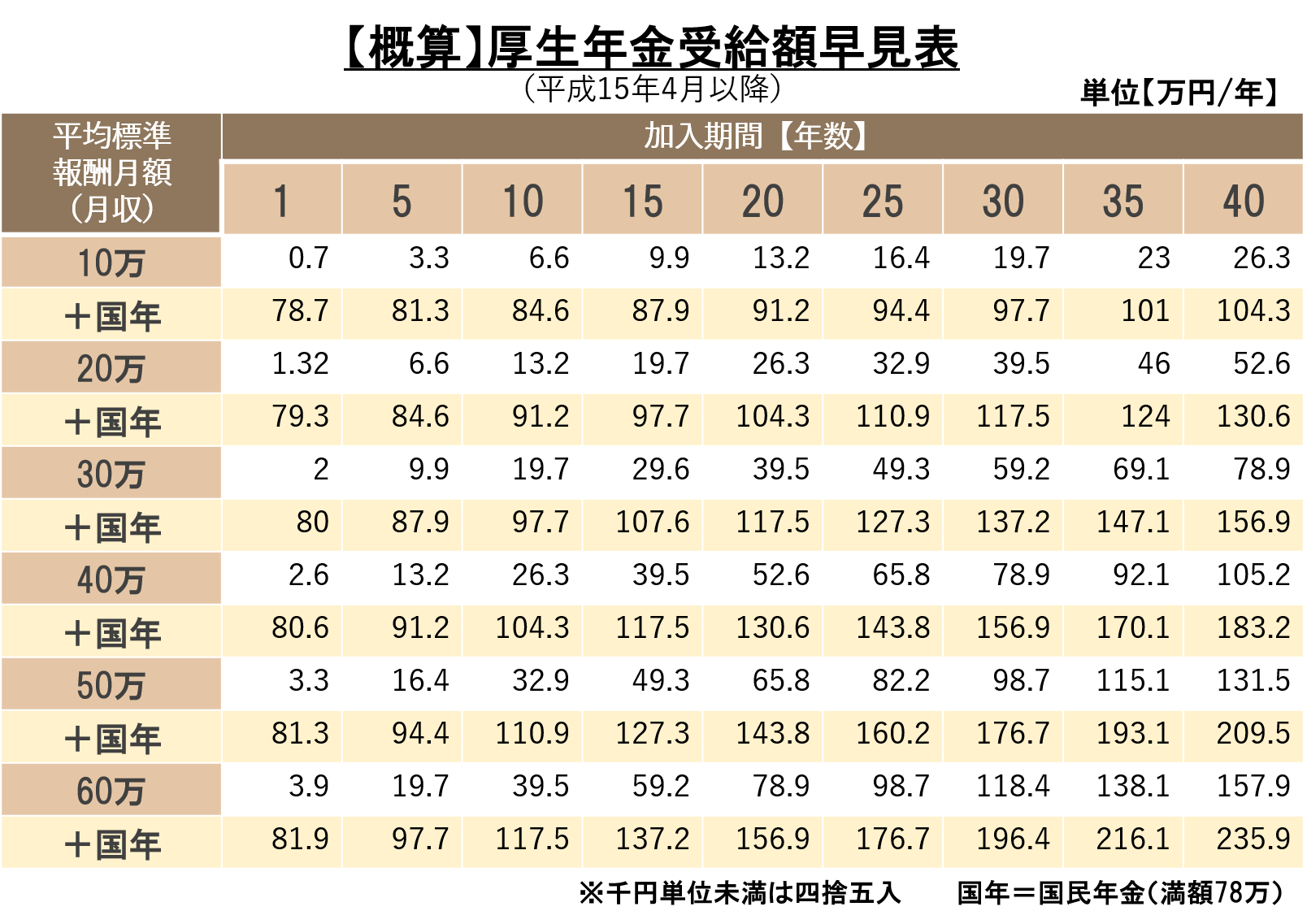

The amount of 厚生年金 benefits you will receive depends on your salary, the number of years you have worked, and your age when you retire.

When can I start receiving 厚生年金 benefits?

You can start receiving 厚生年金 benefits as early as age 60, but you will receive a reduced benefit if you retire before age 65.

What are the benefits of 厚生年金?

厚生年金 provides a number of benefits, including:

- Retirement income

- Disability benefits

- Survivor benefits

- Health insurance

- Long-term care insurance

How can I apply for 厚生年金 benefits?

You can apply for 厚生年金 benefits at your local pension office.

FAQs on National Pension: Essential Knowledge for a Secure Retirement

Understanding the National Pension System is paramount for planning a financially stable retirement. To assist in this endeavor, here are some frequently asked questions (FAQs) to address common concerns and misconceptions.

精神安定する方法とは?体・思考・行動を変えて感情を調整しよう - 健康情報コラム - Source www.suntory-kenko.com

Question 1: Who is eligible for National Pension?

All Japanese citizens aged 20-59 are legally required to enroll in the National Pension System. Expatriate residents who work in Japan for more than a year may also be eligible.

Question 2: How much will I receive in National Pension benefits?

The amount received depends on the number of years of contribution and the amount of premiums paid. However, the minimum monthly benefit is approximately 78,000 yen.

Question 3: When can I start claiming National Pension benefits?

Generally, the earliest age one can start claiming benefits is 65. However, there are exceptions for those who have made a certain number of contributions before age 60.

Question 4: What if I have not paid National Pension premiums for a period of time?

Gaps in premium payments can reduce the amount of benefits received. However, it is possible to make lump-sum payments to cover missed contributions.

Question 5: What is the role of the Elderly Care Insurance system?

The Elderly Care Insurance system provides financial support for long-term care expenses. It complements the National Pension System and helps ensure a comprehensive safety net for seniors.

Question 6: How can I estimate my future National Pension benefits?

The Japan Pension Service provides online tools and calculators to help individuals estimate their potential benefits. It is recommended to use these tools regularly to stay informed and make informed decisions about retirement planning.

In conclusion, the National Pension System is a crucial component of financial security in retirement. By understanding the basics and addressing common concerns, individuals can make informed choices to ensure a stable and fulfilling later life.

To learn more about the National Pension System and other retirement planning strategies, refer to the following articles:

Tips to Secure Stable Post-Retirement Life

Planning for retirement is crucial for financial security and well-being in later years. Understanding the basics of the national pension system, known as 厚生年金: 老後の安定した生活のために知っておきたい基礎知識, is essential. Here are some tips to help you navigate this system and prepare for a comfortable retirement:

Tip 1: Calculate your estimated pension benefits to understand your financial outlook. Use the

認知 症 検査 絵 の 覚え 方 - Source www.strait3d.com

Pension Calculator on the Japan Pension Service website to determine your potential monthly pension at different ages.

Tip 2: Maximize your contributions to the pension system. Even small additional contributions can significantly increase your pension benefits in the long run. Consider making voluntary contributions or earning additional income through part-time work or investments.

Tip 3: Familiarize yourself with the various types of pensions available. These include the Employees' Pension Insurance, the National Pension, and the Basic Pension. Each pension has different eligibility requirements and benefit structures. Determine which ones are applicable to your situation.

Tip 4: Verify your pension record periodically to ensure its accuracy. Discrepancies can affect your future benefits. Contact the Japan Pension Service to review your record and make any necessary corrections.

Tip 5: Explore other income sources to supplement your pension. Consider part-time employment, rental properties, or investments to generate additional funds and enhance your financial stability.

Tip 6: Consult with a financial advisor or pension expert if you have questions or need guidance. They can provide personalized advice and help you create a comprehensive retirement plan that meets your specific needs.

By following these tips and actively engaging with the pension system, you can increase your financial preparedness and secure a stable and fulfilling life after retirement.

National Pension: Essential Knowledge for a Stable Retirement

老後のお金はどのくらいあればいい?どうやって積み立てる? | 保険の教科書 - Source hoken-kyokasho.com

Understanding the National Pension system is crucial for planning a financially secure retirement. Here are six key aspects to be aware of:

- Eligibility: Know who is eligible for coverage and how to apply.

- Contribution Rates: Understand how much you and your employer contribute and the impact on your pension.

- Pension Amount: Calculate your estimated pension based on factors like earnings and contribution period.

- Retirement Age: Be aware of the minimum and eligible retirement ages and their effect on your pension.

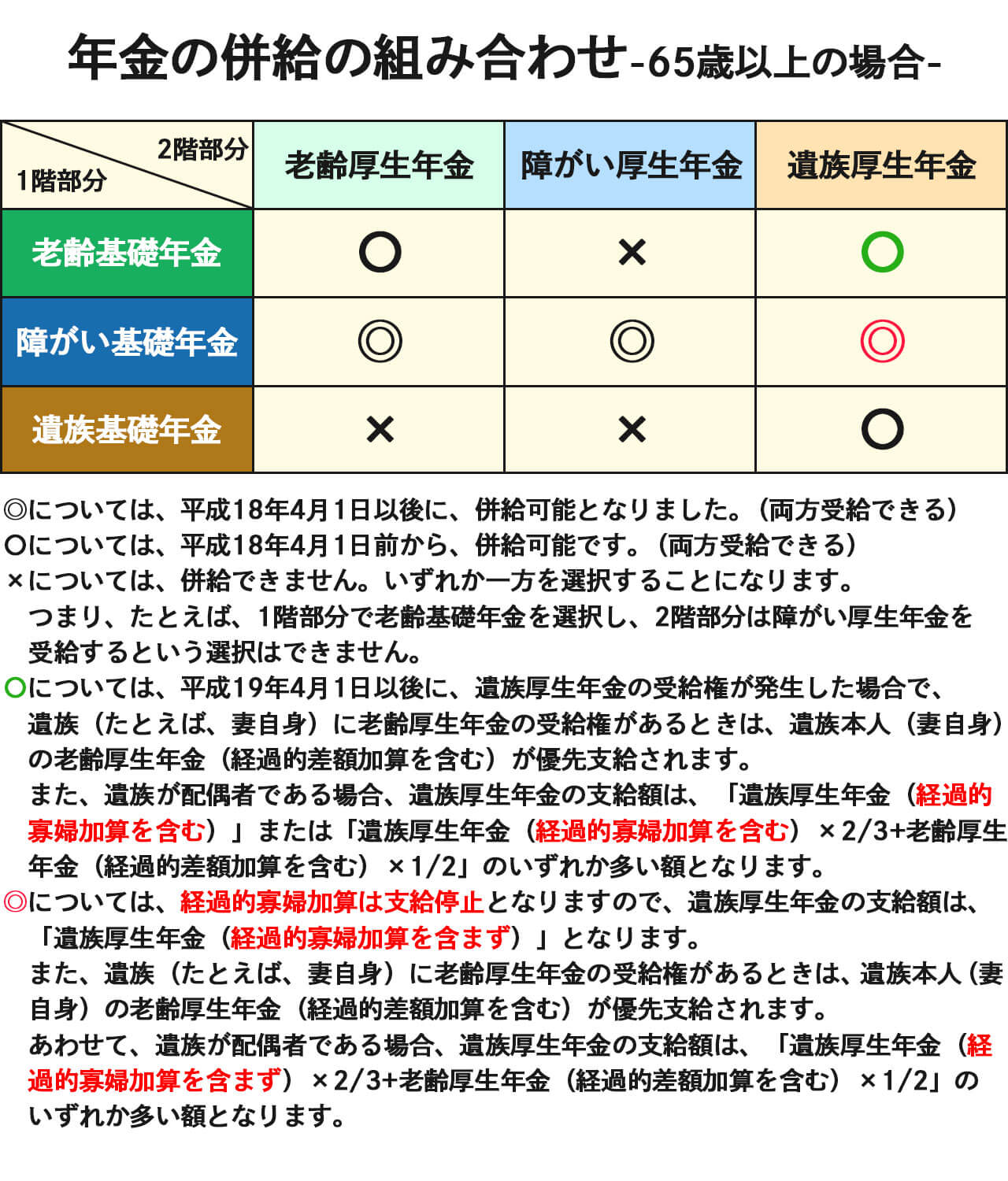

- Survivor Benefits: Learn about the benefits available to your dependents in case of your death.

- Disability Benefits: Understand the criteria and benefits for those unable to work due to disability.

These aspects are interconnected and influence the stability of your retirement income. Ensuring your eligibility, contributing consistently, and planning for retirement based on estimated pension amounts are essential. Disability and survivor benefits provide a safety net for unexpected life events. By understanding these key aspects, you can make informed decisions to secure a comfortable and financially secure retirement.

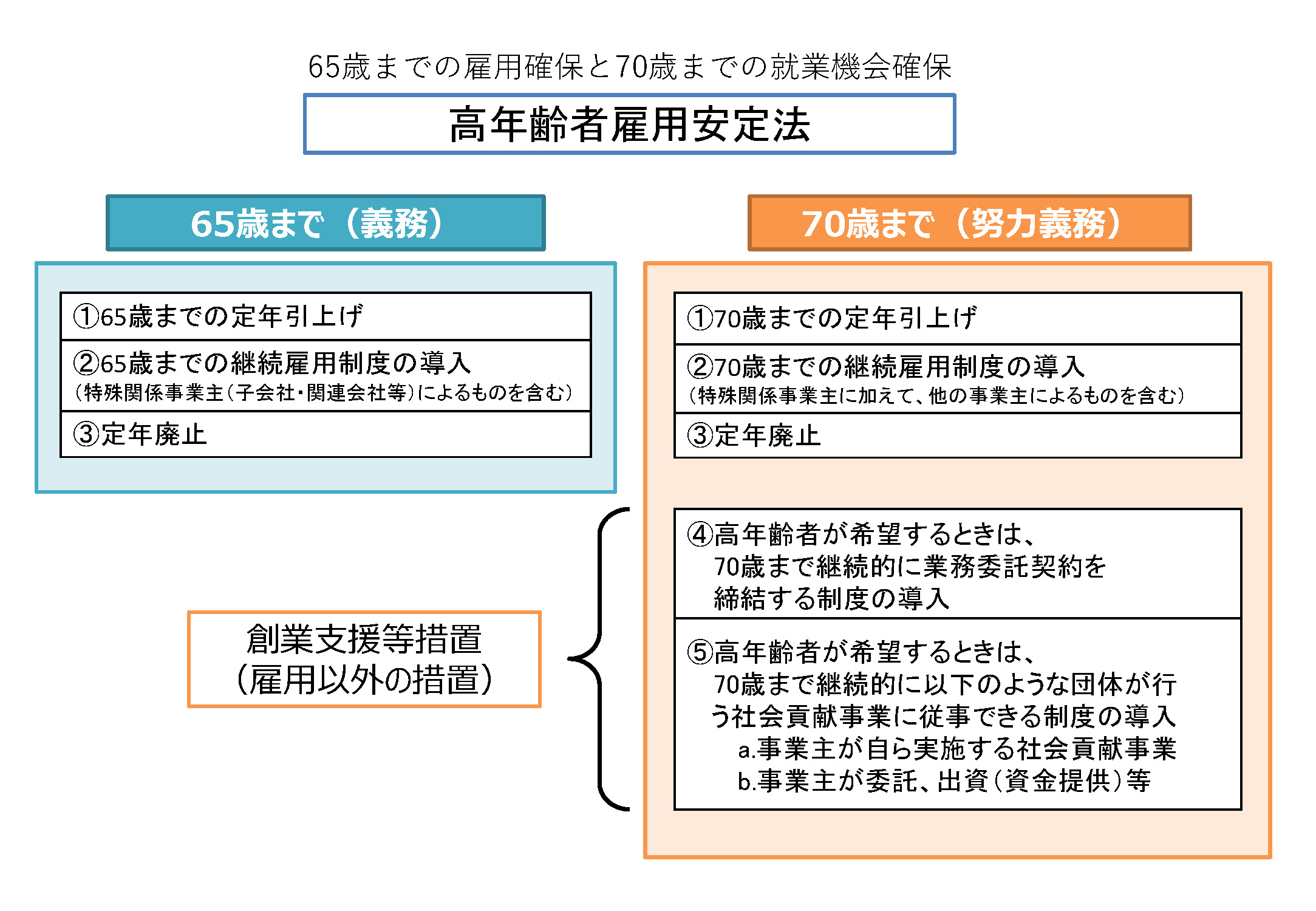

高年齢者雇用安定法 - 公益社団法人 全国ビルメンテナンス協会公益社団法人 全国ビルメンテナンス協会 - Source www.j-bma.or.jp

厚生年金: 老後の安定した生活のために知っておきたい基礎知識

The "厚生年金: 老後の安定した生活のために知っておきたい基礎知識" article provides a detailed overview of the Japanese pension system. The article covers a wide range of topics, including:

【図解】ですぐ理解できる!会社員が加入する厚生年金をわかりやすく解説! | マネスタブログ - Source www.money-studylog.com

- How the pension system works

- The different types of pensions available

- The eligibility requirements for each type of pension

- The amount of pension you can expect to receive

- Tips for maximizing your pension benefits

This article is an essential resource for anyone who wants to learn more about the Japanese pension system. The information provided in the article can help you make informed decisions about your retirement planning. To summarize, understanding the content of "厚生年金: 老後の安定した生活のために知っておきたい基礎知識" is crucial for individuals seeking financial stability in their aging years, guiding them toward informed decisions for a secure post-retirement lifestyle.

By understanding how the pension system works, you can make sure that you are taking steps to maximize your benefits. The article provides several tips for maximizing your pension benefits, such as:

| Tip | Benefit |

|---|---|

| Start contributing to the pension system as early as possible. | The sooner you start contributing, the more money you will have in your account when you retire. |

| Make sure you are contributing enough money to the pension system. | The more money you contribute, the higher your pension benefits will be. |

| Take advantage of tax breaks for pension contributions. | You can reduce your tax bill by contributing to the pension system. |

| Consider working longer. | The longer you work, the more money you will have in your pension account. |